Dips are inevitable. They happen suddenly yet wipe out millions of dollars from both crypto and stock markets. However, the occurrence in the former type of market is more frequent since the market size is relatively small: the total market capitalization of the U.S. stock market is currently $48,6 trillion (9/30/2021) according to the Siblis research, while the total market cap of crypto is $2,3 trillion (21/12/2021) according to the CoinMarketCap. We can clearly see how the crypto market is smaller in comparison to the US stock market. At the time of writing, Bitcoin (BTC) has a market cap of $0.9 trillion, constituting 40.8% of the crypto market cap (also known as bitcoin dominance).

Looking at numbers, one can suspect that some big market players can impact the price of coins (tokens) relatively easily in both directions.

For example, on May 17, 2021, the market saw over $2.4 billion in crypto liquidations. The entire crypto market took an aggressive 66% downturn within 12 hours and then proceeded to regain back 50% of the losses the following 12-hour period.

Dips usually trigger fear among investors, however, those who believe in their investments’ future, see dips as an opportunity to accumulate even more at a cheaper price (also known as Dollar Cost Averaging (DCA)). But there is an issue we all face during dips: We don’t have enough capital to invest more. How can we get extra cash or crypto to invest further during this turbulent phase? In this article, I will explain how this issue can be tackled with the help of a Crypto-Backed Loan that will be offered by MELD.

How does it work?

The initial service MELD will offer will be instant crypto-backed loans. First, a user will deposit their cryptocurrency to MELD as collateral. The protocol will then use the deposited cryptocurrency to create a collateralized debt position (CDP). A smart contract records the terms of the loan and registers it on the blockchain. Upon KYC/AML confirmation, the protocol will execute a wire transfer directly to a bank account. Users will be able to manage their CDP directly from the MELDapp.

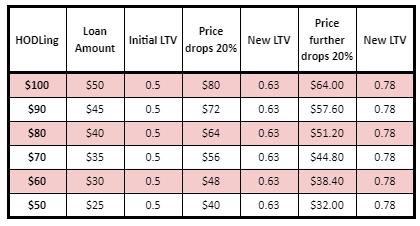

Loans are issued at a Loan to Value (LTV) ratio of 50%. If the collateral value falls to LTV 65% or stays above 50% for more than three days, a margin call happens. The customer must provide added collateral to bring the loan back to an LTV of 50%. The same happens if the LTV reaches 75%. If the LTV reaches 85%, a liquidation event is triggered where the collateral is converted to USD/EUR stable coins equivalent to the fiat loan plus a 5% fee. Further info can be found in the MELD whitepaper.

However, it is important to mention that, thanks to the advanced risk model, a user should not experience liquidation of their position if the rebound is within such a brief period as it happened on May 17, 2021.

Additionally, you can enjoy taking crypto-backed loans without enacting a taxable event.

What is the best strategy to take a loan?

Imagine Ser Bob having 100$ worth of BTC. If he wants to get a crypto-backed loan, he can take up to $50 in a fiat or crypto equivalent loan. Though the advanced risk model that is used at MELD will help Bob to guard against short-term extreme volatility, he also needs to hedge his risk accordingly. We all have probably experienced this: Price goes down, you start to think it is a dip, you begin to accumulate since it is a dip, but then price still goes down and so forth…

It would be useful for Bob to use at max 70-80% of his holdings for the first time taking a loan. Because then he can be prepared for a further drop in the price. But let’s crunch the numbers and put them in a perspective for us in simple terms:

As I wrote before, he is hodling $100 worth of crypto, for your reference, I decreased this number further until $50. If the price drops by 20% from the point he got his loan, the new LTV ratio becomes 0.63, and he gets a margin call. So, he needs to provide further collateral. If the price further drops by 20%, the new ratio equals 0.78 and he receives another margin.

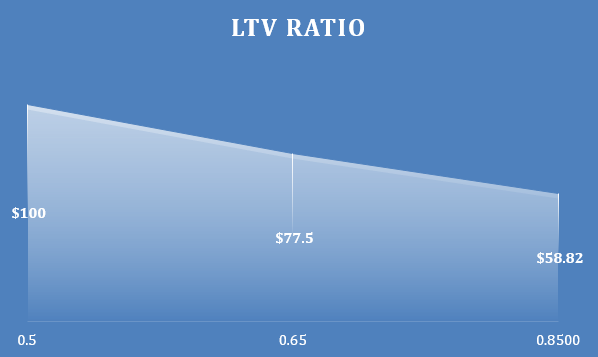

The extreme case can be if the price at first drops by 22.5% and further by 24.1% (this example is one of the out-of-many combinations) and his position gets liquidated. Below this case is described with a simple chart:

Conclusion

Instant crypto-backed loans that will be offered are revolutionary in the crypto space since it will enable the borrower to get a loan in fiat or crypto equivalent. Proceedings out of the loan can be used in multiple ways. In this article, I briefly touched on how it can be used to buy dips (the same logic can apply to stock market dips). Additionally, considerations for Ser Bob while taking a loan were mentioned, and certain cases were analyzed. Ser Bob is now ready to take his first crypto-backed loan at MELD!

Disclaimer

The information provided in this marketing material is for educational and informational purposes only and should not be construed as financial or investment advice. Cryptocurrencies are highly volatile and speculative assets that can experience significant price fluctuations. Past performance is not indicative of future results. Any forward-looking statements reflect MELD’s views at the time such statements were made with respect to future events and are not a guarantee of future performance or developments. You are strongly cautioned that reliance on any forward-looking statements involves known and unknown risks and uncertainties. You should conduct your own research and consult with a financial advisor before making any investment decisions. The issuer of this marketing material assumes no liability for any financial losses or damages resulting from your reliance on the information provided herein.

If you believe in the MELD vision, want to support this initiative, and want to help promote the future of finance then we want you to join the MELD Ambassador Program!

.jpg)